FLAGSHIP PRODUCT

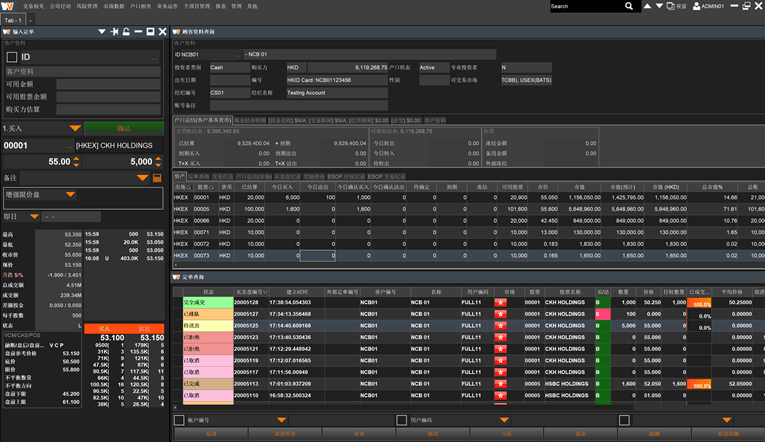

WinVest™

What is WinVest™?

WinVest™ offers comprehensive support for multi-asset class in multi-market order and trade management services. Its unique architecture empowers extensive operations, ranging from huge data set manipulation in Back Office and Middle Office as well as performance seeking Front Office Trading. WinVest™ has been deployed and trusted by our clients for more than a decade with proven technologies and advanced development platform, featuring plug-in technologies of which algo-trading, smart order routing, trade allocation, real-time trade confirmation and loads of automated services could be implemented readily with plugins to facilitate cooperative development model.

Multi-Asset Class Management:

- Cash Equities

- Futures

- Options

- Stock Options

- Fixed Incomes

- Funds

- Structured Products

Integrated Risk Management System:

- Centralized Risk Management

- Real-time Margin Management

- Risk Assessment and Control

Multiple Platforms:

- PC Application (PC and Mac)

- Mobile (supports Android and iOS)

- Tablet (supports Android and iOS)

- Web (Support supports latest browser)

Easy to Use:

- High Performance

- No more middleware

Platform Independent:

- High Scalability and High Availability

- Lower Total Cost of Ownership

User friendly Customizable settings:

- Customizable user screen layout, on ALL platforms, saved as user settings.

Easy to Configure and Manage:

- All settings saved in server so that administrator could update settings easily

- Pluggable and Extensible Core

Benefits:

- Benefits Low Operational & Maintenance efforts as well as cost

- Self-DR concept in Cloud service

- Flexibility for growing business

- Environmental friendly

Cutting Edge:

- Resilient

- Security

- Consumability

- Performance ability

Pre-trade provision:

- Credit risk control

- Margin / Loans module incorporated

- Real-time supervisor approval for risk management

Unified Web Administration:

- Administrative operations via Web-Based-Interface

- Zero-impact to business -Low maintenance cost

Post-trade facileness:

- Interface with Exchanges and External Brokers

- Harmonization of Clearing principles

- Contract matching readiness

Execution manageability:

- Industrial standard order type support

- Manual execution support (OTC, Phone broker)

- Single Orderbook for parallel monitoring

- Multiple market data provider support for real-time quotes

- Tailor-made trading screen

- Instant automated trade confirmation

Data Extension Statement and Reporting:

- Handy management information reporting for business analysis

- Informative and exquisite client statement

- Customizable external interface

Additional benefits:

- Hierarchical system supervision

- Real-time realization of cash and derivatives

- Electronic data distribution ready

- Comprehensive logging for auditing